Our Guest Author Today: Matthew Schwimmer

Perfect, ideal, dreamlike - these appear to be the words we chase throughout

our lives. The tricky thing about them is they often lead to heartbreak. When

the worst does happen, it can seem impossible to recover from. Still, if we

were to peel away a few layers and scratch under the surface, we would realize

that they are just words. Words we gave too much meaning to. Finding the

picture-perfect house is an arduous journey; it takes a lot out of you.

Reaching the finish line and having the rug pulled out from under your feet is

a horrible experience. As you crash to the ground, so do your dreams. Or do

they? See, the thing with words is, we misuse them. There is no one single

perfect object but many semiprecious ones. It's never as bad as it may seem.

Here is a quick guide on

how to cope when you lose the bidding war on

your dream home.

The Process of Grieving

Seems like a good place to start. Why? Simply because, even if you are the

most well-grounded, rational, logically-oriented person in the world, you can't

skip those feelings of anger and frustration. So, you should allow yourself to

go through the five well-known stages. As you slug through denial, anger,

bargaining, and depression, you will know you are one step closer to that

all-important acceptance. The sooner you get there, the quicker you

can get back on your feet. New houses await; new finish lines are calling to

you. Just keep this in mind, there are many impressive houses out there. Yes,

you missed out on one, but at the end of the day, you missed out on one.

This first stage is crucial, as you need to be clear-headed to

prepare for the subsequent phases.

The Learning Process

Mistakes are only helpful if we learn something from them. I understand that

at this point, you might be asking yourself if you had misread the title and

have entered into some kind of semi-hippy self-help section of the internet.

Don't worry; you haven't! I just needed to get the philosophical parts of the

recovery process out of the way first. See, in most cases, you will have

utilized the services of an agent, especially if you are buying your first home. They helped you with

the initial process of finding a home and making a bid. They can also help you

now that the deal has fallen through. Ask them why it didn't work out. This

knowledge will be crucial, as it means you can adjust your strategy

accordingly. It could stop you from losing the bidding war next time round.

Life

is one big learning experience, we never really leave the classroom, and the

more we know, the wiser our actions will be

The Budget

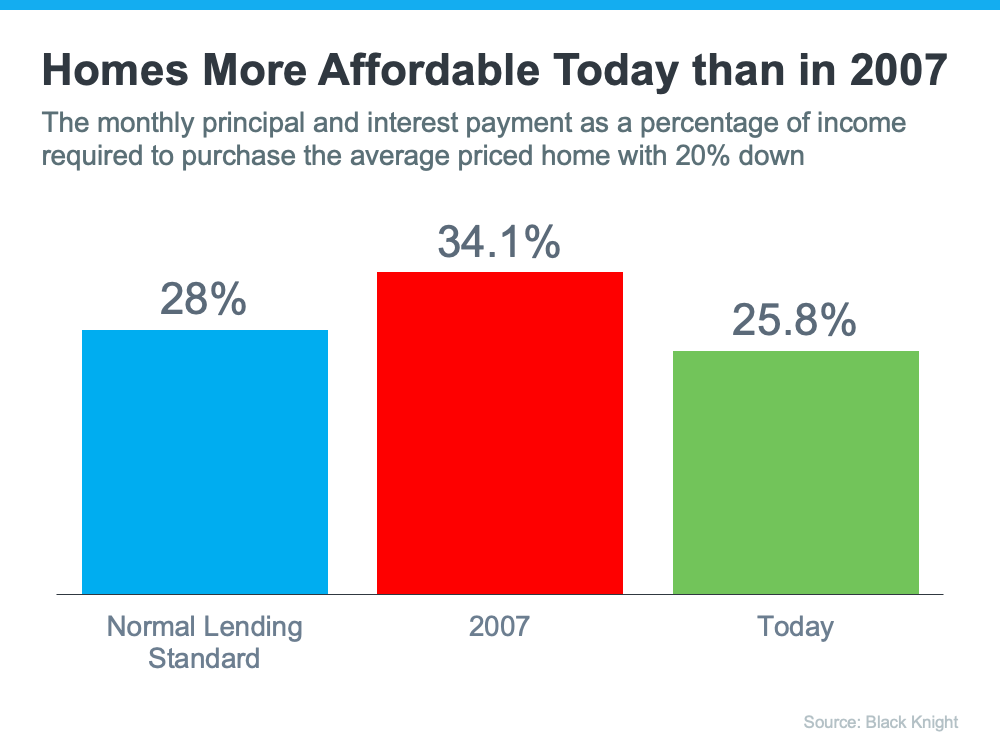

Now we get to the more practical part. An excellent place to start is your price

range. This is a good tip you can use at any time, but especially when

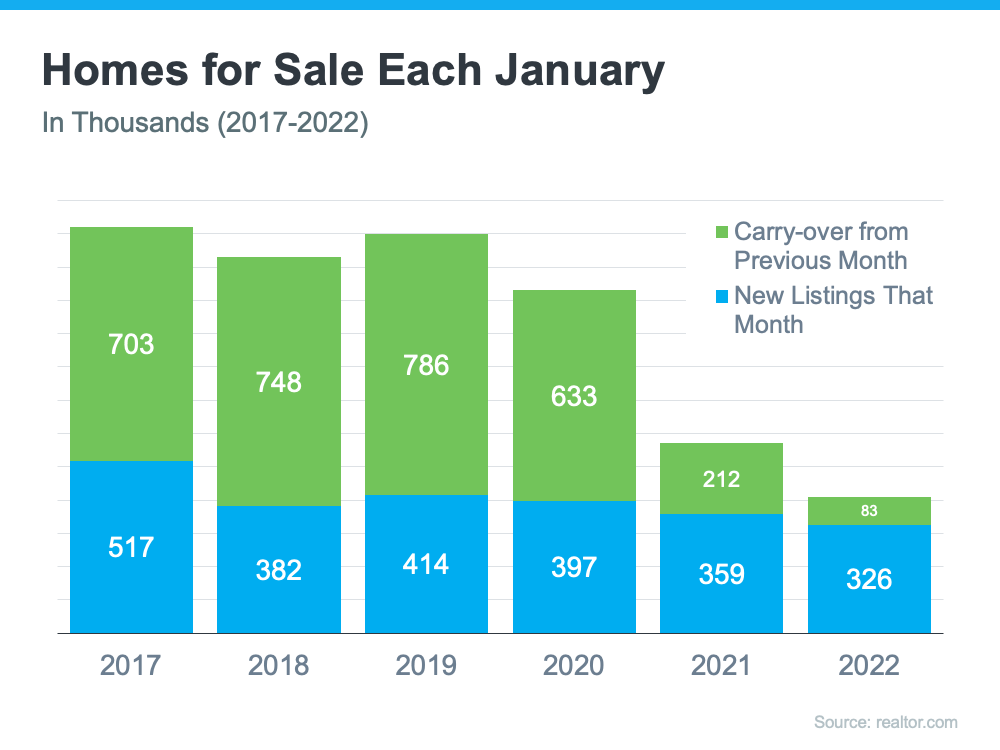

inventory is low and you are looking at a 'seller's market'. You will always

have several buyers competing for the same house in these cases, and a bidding

war is almost unavoidable. It would help if you had some bidding power.

You can acquire it by not looking at homes at the top of your budget. With

these homes, you are already stretched to the limit. If it is expected that the

house will sell, for example, at 10% over the initial asking price, you've

already lost the battle. Leave a little leeway; give yourself some wiggle room.

If you can offer 10% above the asking price and are bidding against others who

are already at the top of their max budget, the math is on your side! Another

aspect to consider is the

purchasing power, which is fortunately not all that difficult to calculate.

Never

have a couple of toys so perfectly encapsulated the process; you need to find

the perfect house in accordance with a realistic budget

Escalation Clause

This is a nifty little tool. It can seriously lower the chances of you being

outbid. It essentially means you are offering to pay a certain sum above the

highest bid the seller has received. In other words, you can't be taken out of

the running so easily by the aforementioned pesky rug at the end of the

finish line! Of course, you can set a limit, so the

opposite doesn't happen, and you end up offering way above what you can

realistically afford. You can also employ other tactics to make your offer more

attractive. Getting a pre-approval is all the rage in 2022, and for a good reason.

How to Cope When You Lose the Bidding War on Your Dream Home? Heard of the

80-20 Rule?

This lovely rule ties in quite neatly with what I was talking about earlier,

you know, when I seemed to be more concerned with the derivation of words and

your outlook on life rather than buying homes. What the rule boils down to is

that "no house is perfect." Say it with me; no house is perfect.

So if you are already on evolutionmoving.com

looking to get a quote for the move just because you think you've found a

one-of-a-kind home, hold on for a just little while longer. In most cases, the

most a home will fulfill is 80% of your requirements and wants. To be clear,

this is a very substantial amount. Hence, the illusion of perfection. The

problem is you think there are no more like it. Experience has taught us

otherwise. See, the next home could have a different 80%, some features that

the one you lost didn't. That could make it just as good, maybe even better.

Furthermore, there are some home features you can recreate. If you saw

something interesting, maybe think about how it could be implemented in a

different house.

Pause

Let's have a breather.

Better? Always helps when you slow things down. There is one more thing that

could help. It's circumstantial, as someone under pressure to find a home

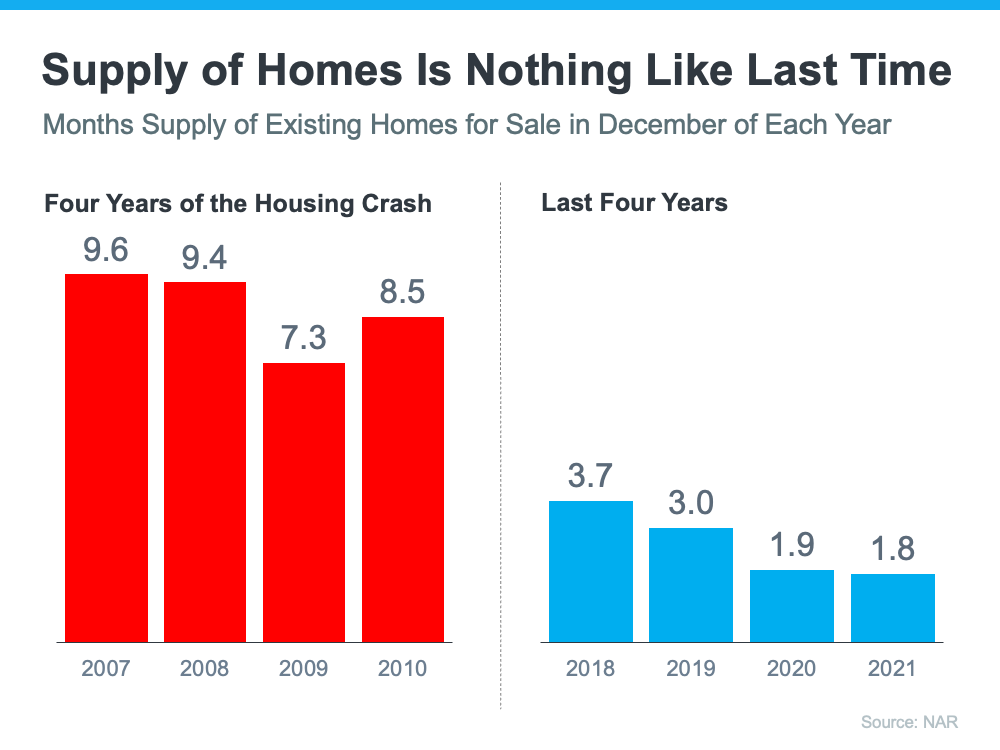

doesn't have this luxury, but if you do, you can always wait for inventory to

improve. If homes, especially good ones, are scarce, playing the waiting game

for a bit could work to your advantage. In the meantime, you can always read up

on why the housing supply remains relatively low and plan accordingly.

How

to cope when you lose the bidding war on your dream home? Sometimes it's best

to take a break and wait for things to settle a little

Let's Take a Step Back

We haven't touched upon the actual process of buying your first home. Now

that you know how to handle the potential heartbreak of losing your first

bidding war, which, I hope you now see, is not all that tragic, let's take a

look at what comes before that. As a first-time buyer, there are many things

for you to consider. There is a lot to do from the initial decision to a list

of wants and needs, all the way through questions of financing, home

inspections, and finding a good realtor. Therefore, if you are a first-time buyer, be sure you are ready for what lies ahead. The

better prepared you are, the smoother the journey will be.

Closure

There you have it, how to cope when you lose the bidding war on your dream

home! As you can see, it's not as bleak as it may have initially appeared;

nothing in life ever is. Thought you were going to get out of this without a

big philosophical ending, did you? Fat chance! It may be tiring, it may be

frustrating, but once it's your turn to come out as the winner and you finally

move into your new home, you'll see it was worth it. After all, it's not about

the journey, but the destination, and what makes a home great are the people

living there, not hardwood floors and ceramics!

Guest Author:

Matthew Schwimmer, Blogger and Writer

https://evolutionmoving.com

Pictures Used:

https://pixabay.com/photos/money-home-coin-investment-2724245

https://unsplash.com/photos/OyCl7Y4y0Bk

https://unsplash.com/photos/NpTbVOkkom8

https://www.pexels.com/photo/keyboard-keys-in-a-bowl-8386425