San Antonio’s best Real Estate Blog for the most relevant and comprehensive information for buyers, sellers, and real estate agents. Search the San Antonio MLS for homes, houses for sale, land and property for sale. Find new homes, first time buyer help, military, relocation, seniors, investors, FSBO, houses for rent, current market information, the latest real estate news, schools, lots more. Texas Today Realty

Why Homeownership Is Still The American Dream

If You’re a Buyer, Is Offering Asking Price Enough?

In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the asking price they can offer and still get the home. From there, the buyer and seller typically negotiate and agree on a revised price somewhere in the middle.

Things Are Different Today

Today’s housing market is anything but normal. According to the National Association of Realtors (NAR), homes today are:

- Receiving an average of 3.8 offers

- Selling in just 17 days

Homes selling quickly and receiving multiple offers highlights how competitive the housing market is right now. This is due, in large part, to the low supply of homes for sale. Low supply and high demand mean homes often sell for more than the asking price. In some cases, they sell for a lot more. Selma Hepp, Deputy Chief Economist at CoreLogic, explains how these stats can impact buyers:

“The imbalance between robust demand and dismal availability of for-sale homes has led to a continual bidding over asking prices, which reached record levels in recent months. Now, almost 6 in 10 homes listed are selling over the asking price.”

You May Need To Rethink How You Look at a Home’s Asking Price

What does that mean for you? If you’ve found your dream home, you need to be realistic about today’s housing market and how that impacts the offer you’ll make. Offering below or even at a home’s asking price may not cut it. In today’s market, the highest bidder often wins the home, much like at an auction.

Currently, the asking price is often the floor of the negotiation rather than the ceiling. If you really love a home, it may ultimately sell for more than the sellers are asking. That’s important to keep in mind as you work with your agent to craft an offer.

Understand An Appraisal Gap Can Happen

Because of today’s home price appreciation and the auction-like atmosphere in the selling process, appraisal gaps – the gap between the price of your contract and the appraisal for the house – are more frequent.

According to data from CoreLogic:

“Beginning in January 2020, nationally, 7% of purchase transactions had a contract price above the appraisal, but by May 2021, the frequency had increased to 19% of purchase transactions.”

When this happens, your lender won’t loan you more than the home’s appraised value, and the seller may ask you to make up the difference out of pocket. Buyers in today’s market need to be prepared for this possibility. Know your budget, know what you can afford, and work with a trusted advisor who can offer expert advice along the way.

Bottom Line

Bidding wars and today’s auction-like atmosphere mean buyers need to rethink how they look at the asking price of a home. Let’s connect so you have a trusted real estate professional who can advise you on the current market and help determine what the market value is on your dream home.

Content previously posted on Keeping Current Matters* This article was originally published here

The New Homeowners

Time for a New home

Holy Cross - Mother Guerin High Schools

Tips for Todays Sellers

Is a 20% Down Payment Really Necessary To Purchase a Home?

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is the biggest hurdle.

That may be because those individuals assume a 20% down payment is necessary. While putting more money down if you’re able can benefit buyers, putting 20% down is not mandatory. As Freddie Mac puts it:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

If saving that much money sounds overwhelming, you might be ready to give up on the dream of homeownership before you even begin – but you don’t have to. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. It may sound surprising, but today’s average down payment is only 12%. That number is even lower for first-time homebuyers, whose average down payment is only 7%.

Based on the Home Buyers and Sellers Generational Trends Report from NAR, the graph below shows an even closer look at the down payment percentage various age groups pay: As the graph shows, the only groups who put 20% or more down on average are older homebuyers who likely can use the sale of an existing home to fuel a larger down payment on their next home.

As the graph shows, the only groups who put 20% or more down on average are older homebuyers who likely can use the sale of an existing home to fuel a larger down payment on their next home.

What does this mean for you?

If you’re a prospective homebuyer, it’s important to know you don’t have to put the full 20% down. And while saving for any down payment amount may feel like a challenge, keep in mind there are programs for qualified buyers that allow them to purchase a home with a down payment as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, you do need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com. Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Bottom Line

Don’t let the myth of the 20% down payment halt your homebuying process before it begins. If you want to purchase a home this year, let’s connect to start the conversation and explore your options.

Content previously posted on Keeping Current Matters* This article was originally published here

Top Reasons to Own Your Home

An Agent Will Be Your Expert Guide Through Your Home Sale

Have You Ever Seen a Housing Market Like This? [INFOGRAPHIC]

![Have You Ever Seen a Housing Market Like This? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2021/09/16133051/20210917-KCM-Share-549x300.png)

Some Highlights

- Whether you’re buying or selling – today’s housing market has plenty of good news to go around.

- Buyers can take advantage of today’s mortgage rates to escape rising rents and keep monthly payments affordable. Sellers can reap the benefits of multiple offers and a fast sale.

- If this sounds like good news to you, let’s connect today so you can capitalize on the unique opportunity you have in today’s market.

* This article was originally published here

Talking About Your New Home

Time

Is the Number of Homes for Sale Finally Growing?

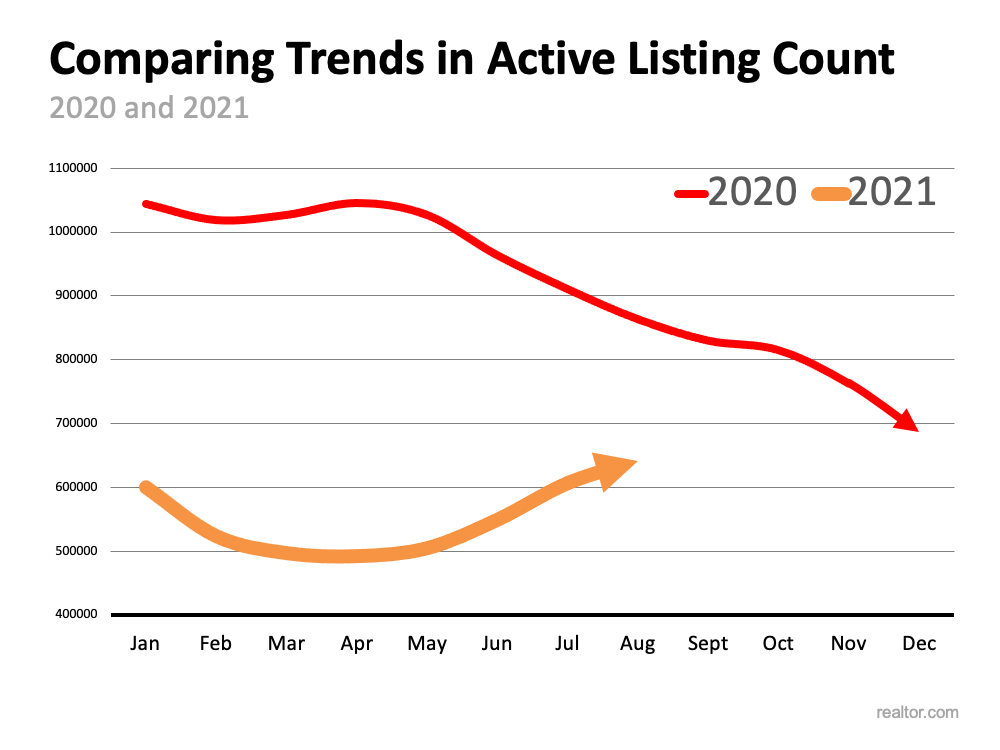

An important metric in today’s residential real estate market is the number of homes available for sale. The shortage of available housing inventory is the major reason for the double-digit price appreciation we’ve seen in each of the last two years. It’s the reason many would-be purchasers are frustrated with the bidding wars over the homes that are available. However, signs of relief are finally appearing.

According to data from realtor.com, active listings have increased over the last four months. They define active listings as:

“The active listing count tracks the number of for sale properties on the market, excluding pending listings where a pending status is available. This is a snapshot measure of how many active listings can be expected on any given day of the specified month.”

What normally happens throughout the year?

Historically, housing inventory increases throughout the summer months, starts to tail off in the fall, and then drops significantly over the winter. The graph below shows this trend along with the month active listings peaked in 2017, 2018, and 2019.

What happened last year?

Last year, the trend was different. Historical seasonality wasn’t repeated in 2020 since many homeowners held off on putting their houses up for sale because of the pandemic (see graph below). In 2020, active listings peaked in April, and then fell off dramatically for the remainder of the year.

What’s happening this year?

Due to the decline of active listings in 2020, 2021 began with record-low housing inventory counts. However, we’ve been building inventory over the last several months as more listings come to the market (see graph below): There are three main reasons we may see listings continue to increase throughout this fall and into the winter.

There are three main reasons we may see listings continue to increase throughout this fall and into the winter.

- Pent-up selling demand – Homeowners may be more comfortable putting their homes on the market as more and more Americans get vaccinated.

- New construction is starting to take off – Though new construction is not included in the realtor.com numbers, as more new homes are built, there will be more options for current homeowners to consider when they sell. The lack of options has slowed many potential sellers in the past.

- The end of forbearance will create some new listings – Most experts believe the end of the forbearance program will not lead to a wave of foreclosures for several reasons. The main reason is the level of equity homeowners currently have in their homes. Many homeowners will be able to sell their homes instead of going to foreclosure, which will lead to some additional listings on the market.

Bottom Line

If you’re in the market to buy a home, stick with it. There are new listings becoming available every day. If you’re thinking of selling your house, you may want to list your home before this additional competition comes to market.

Content previously posted on Keeping Current Matters* This article was originally published here

Time Is Money When It Comes to Your Home

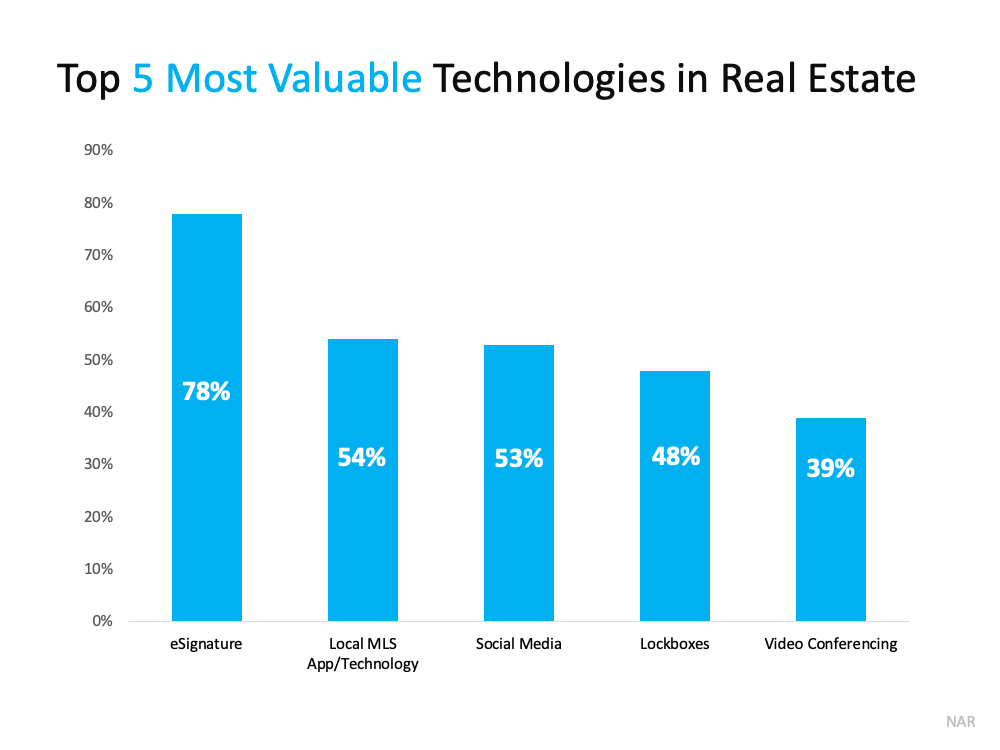

Why It’s Still Safe To Sell Your Home

If you’re on the fence about whether or not you want to sell your house this year, there’s good news. Real estate professionals are highly experienced in how to sell houses safely during the pandemic. Over the last year, agents have adopted new technologies and safety measures designed to keep you safe. And experts say these practices are here to stay. As Bob Goldberg, CEO of the National Association of Realtors (NAR), puts it:

“The pandemic has confirmed to all of us in the industry that technology will continue to transform real estate.”

Below is a closer look at some of the new tools real estate professionals are using to better serve sellers.

New and Existing Technology Are Impacting the Process

In the 2021 Realtor Technology Survey, NAR asks real estate professionals their opinions on the most valuable pieces of technology for their business over the past 12 months. The graph below highlights the top five tools those agents said are true game-changers: Tools that allow agents to serve clients at a distance and limit exposure to others, including eSignature, lockboxes, and video conferencing, became increasingly important during the last year. Those same tools are just as essential today. Restricting the number of people a seller must interact with during the process is the best way to keep all parties involved in a sale safe.

Tools that allow agents to serve clients at a distance and limit exposure to others, including eSignature, lockboxes, and video conferencing, became increasingly important during the last year. Those same tools are just as essential today. Restricting the number of people a seller must interact with during the process is the best way to keep all parties involved in a sale safe.

Trusted Advisors Stay Up to Date on Guidelines for In-Person Showings

As things change in our day-to-day lives, the guidance on how to stay safe changes as well. NAR regularly updates the resources available to real estate professionals to ensure the latest recommendations and best practices are readily available. This includes suggestions on how to continue to conduct safe in-person showings.

Agents also follow guidance from the Centers for Disease Control (CDC) to make sure homes are safe. The CDC’s advice includes information on how to clean high-touch surfaces like doorknobs, tables, and countertops so they’re disinfected for all.

This past year changed the way agents do things for the better. Real estate professionals use new technology, tools, cleaning procedures, and the latest guidance to meet your changing needs. The goal is to keep you safe and build your confidence throughout the sales process.

Bottom Line

It’s important to know that your safety is still a top priority when it comes to selling this year. Let’s connect today so you can have the best tools available to help you take advantage of today’s sellers’ market.

Content previously posted on Keeping Current Matters* This article was originally published here

Why Were Not Headed for a Housing Crash

Thinking of Buying or Selling a Home This Year

Home Price Appreciation Is Skyrocketing in 2021. What About 2022?

One of the major story lines over the last year is how well the residential real estate market performed. One key metric in the spotlight is home price appreciation. According to the latest indices, home prices are skyrocketing this year.

Here are the latest percentages showing the year-over-year increase in home price appreciation:

- The House Price Index (HPI) from the Federal Housing Finance Agency (FHFA): 18.8%

- The S. National Home Price Index from S&P Case-Shiller: 18.6%

- The Home Price Insights Report from CoreLogic: 18%

The dramatic increases are seen at every price point and in all regions of the country.

Increases Are Across Every Price Point

According to the latest Home Price Index from CoreLogic, each price range is seeing at least a 19% increase year-over-year:

Increases Are Across Every Region in the Country

Every region in the country is experiencing at least a 14.9% increase in home price appreciation, according to the Federal Housing Finance Agency (FHFA):

Increases Are Across Each of the Top 20 Metros in the Country

According to the U.S. National Home Price Index from S&P Case-Shiller, every major metro is seeing at least a 13.3% growth in prices (see graph below):

What About Price Appreciation in 2022?

Prices are the result of the balance between supply and demand. The demand for single-family homes has been strong over the last 18 months. The supply of houses available for sale was near historic lows. However, there’s some good news on the supply side. Realtor.com reports:

“432,000 new listings hit the national housing market in August, an increase of 18,000 over last year.”

There will, however, still be a shortage of supply compared to demand in 2022. CoreLogic reveals:

“Given the widespread demand and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.”

Yet, most forecasts call for home price appreciation to moderate in 2022. The Home Price Expectation Survey, a survey of over 100 economists, investment strategists, and housing market analysts, calls for a 5.12% appreciation level next year. Here are the 2022 home appreciation forecasts from the four other major entities:

- The National Association of Realtors (NAR): 4.4%

- The Mortgage Bankers Association (MBA): 8.4%

- Fannie Mae: 5.1%

- Freddie Mac: 5.3%

Price appreciation is expected to slow in 2022 when compared to the record highs of 2021. However, it is still expected to be greater than the annual average of 4.1% over the last 25 years.

Bottom Line

If you owned a home over the past year, you’ve seen your household wealth grow substantially, and you’ll see another nice boost in 2022. If you’re thinking of buying, consider buying now as prices are forecast to continue increasing through at least next year.

Content previously posted on Keeping Current Matters* This article was originally published here

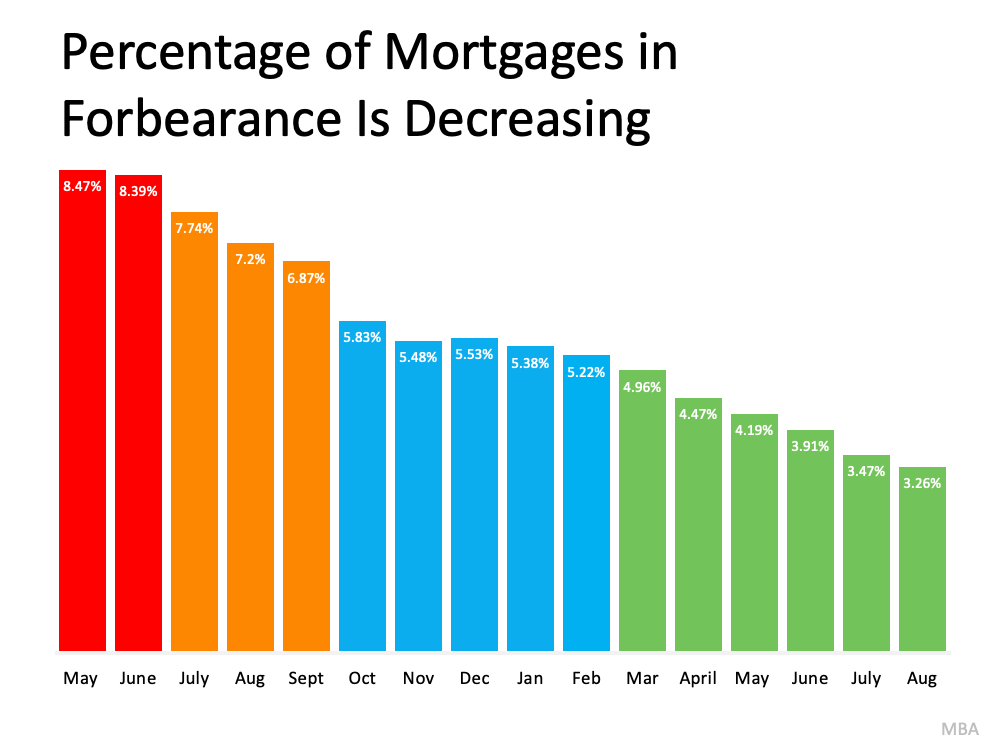

Understand Your Options To Avoid Foreclosure

Even though experts agree there’s no chance of a large-scale foreclosure crisis, there are a number of homeowners who may be coming face-to-face with foreclosure as a possibility. And while the overall percentage of homeowners at risk is decreasing with time (see graph below), that’s little comfort to those individuals who are facing challenges today. If you haven’t taken advantage of the forbearance period, it may be time to research and understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

If you haven’t taken advantage of the forbearance period, it may be time to research and understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

“Foreclosure is the legal process by which a lender attempts to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property. Typically, default is triggered when a borrower misses a specific number of monthly payments . . .”

The good news is, there are alternatives available to help you avoid having to go through the foreclosure process, including:

- Reinstatement

- Loan modification

- Deed-in-lieu of foreclosure

- Short sale

But before you go down any of those paths, it’s worth seeing if you have enough equity in your home to sell it and protect your investment.

Understand Your Options: Sell Your House

Equity is the difference between what you owe on the home and its market value based on factors like price appreciation.

In today’s real estate market, many homeowners have far more equity in their homes than they realize. Over the last year, buyer demand has been high, but housing supply has been low. That’s led to a substantial increase in home values. When prices rise, so does the amount of equity you have in your house.

According to CoreLogic, on average, homeowners gained $33,400 in equity over the last 12 months, and the average equity on mortgaged homes is now $216,000 (see map below): So, what does that mean for you? Over the past year, chances are your home’s value and therefore your equity has risen dramatically. If you’ve been in your home for a while, the mortgage payments you’ve made over time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

So, what does that mean for you? Over the past year, chances are your home’s value and therefore your equity has risen dramatically. If you’ve been in your home for a while, the mortgage payments you’ve made over time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

Frank Martell, President and CEO of CoreLogic, elaborates on how equity can help:

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market.”

Don’t Go at It Alone – Lean on Experts for Advice

To find out what your house is worth in today’s market, work with a local real estate professional. We’ll be able to give you an estimate of what your house could sell for based on recent sales of similar homes in your area. Since home prices are still appreciating, you may be able to sell your house to avoid foreclosure.

If you find out that you have to pursue other options, your agent can help with that too. We’ll be able to connect you with other professionals in the industry, like housing counselors who can look into your unique situation and offer advice on next steps if selling isn’t the best alternative.

Bottom Line

If you’re a homeowner facing hardship, let’s connect to explore your options and see if you can sell your house to avoid foreclosure.

Content previously posted on Keeping Current Matters* This article was originally published here

Fall 2021 Home Buying and Selling Guides

I do believe this is the first time we have shared our publications in quite this way! The Fall 2021 editions are available now. Normally you would have the opportunity to download each of them by registering your information. This time ALL the publications are downloadable from my Google drive - one link gets you there: https://drive.google.com/drive/folders/1zaUkVBtFOXPLONT6nYUqEJY34_PqgaOp?usp=sharing

What Buyers and Sellers Need To Know About the Appraisal Gap

It’s economy 101 – when supply is low and demand is high, prices naturally rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals.

In recent months, it’s become increasingly common for an appraisal to come in below the contract price on the house. Shawn Telford, Chief Appraiser for CoreLogic, explains it like this:

“Recently, we observed buyers paying prices above listing price and higher than the market data available to appraisers can support. This difference is known as ‘the appraisal gap . . . .’”

Why does an appraisal gap happen?

Basically, with the heightened buyer demand, purchasers are often willing to pay over asking to secure the home of their dreams. If you’ve ever toured a house you’ve fallen in love with, you understand. Once you start to picture yourself and your furniture in the rooms, you want to do everything you can to land the property, including putting in a high offer to try to beat out other would-be buyers.

When the appraiser comes in, they look at things a bit more objectively. Their job is to assess the inherent value of the home, so they’re going to study the facts. Dustin Harris, Appraiser Coach, drives this point home:

“It’s important for everyone to understand that the appraiser’s job in the end is to remain that unbiased third party, to truly tell the client what that home is worth in the current market, regardless of what decisions have been made on the price side of things.”

In simple terms, while homebuyers may be willing to pay more, appraisers are there to assess the market value of the home. Their goal is to make sure the lender isn’t loaning more money than the home is worth. It’s objective, rather than emotional.

In a highly competitive market like today’s, having a discrepancy between the two numbers isn’t unusual. Here’s a look at the increasing rate of appraisal gaps, according to data from CoreLogic (see graph below):

What does this mean for you?

Ultimately, knowledge is power. The best thing you can do is understand an appraisal gap may impact your transaction if you’re buying or selling. If you do encounter an appraisal below your contract price, know that in today’s sellers’ market, the most common approach is for the seller to ask the buyer to make up the difference in price. Buyers, be prepared to bring extra money to the table if you really want the home.

Above all else, lean on your real estate agent. Whether you’re a buyer or seller, your trusted advisor is your ally if you come up against an appraisal gap. We’ll help you understand your options and handle any additional negotiations that need to happen.

Bottom Line

In today’s real estate market, it’s important to stay informed on the latest trends. Let’s connect so you have an ally to help you navigate an appraisal gap to get the best possible outcome.

Content previously posted on Keeping Current Matters* This article was originally published here

![Have You Ever Seen a Housing Market Like This? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2021/09/16132958/20210917-MEM.png)